Car title loan weekly payments provide structured debt repayment, aiding financial management and consolidation. Timely payments avoid default, repossession, fees, and penalties, maintaining credit health. Budgeting, setting reminders, and emergency funds help meet deadlines, preventing stress and high-interest rates.

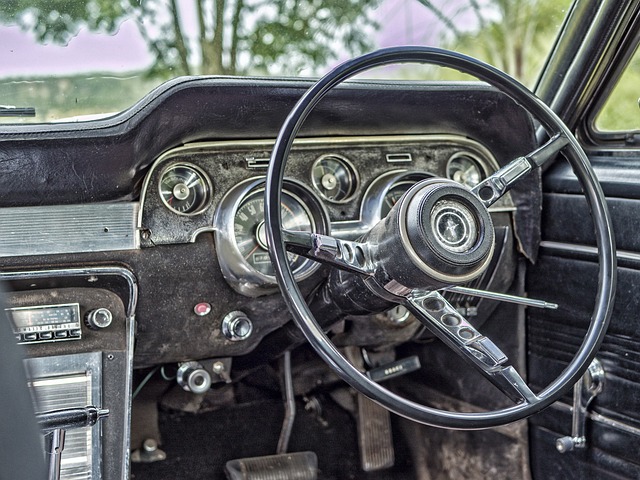

Car title loans, a quick source of cash secured by your vehicle, often come with weekly payments. However, these frequent repayments can pose challenges, leading to missed deadlines if not managed carefully. This article explores the intricacies of car title loan weekly payments, delving into the risks and consequences of delays, while offering practical strategies to help borrowers stay on track. By understanding these aspects, you can make informed decisions to avoid potential pitfalls associated with car title loan repayment.

- Understanding Car Title Loan Weekly Payments

- Risks of Missed Deadlines and Repayment Consequences

- Strategies to Avoid Delays and Stay on Track

Understanding Car Title Loan Weekly Payments

Car title loan weekly payments are a structured way to repay your loan over time. These payments typically involve making consistent, regular contributions towards the principal and interest of your car title loan. Understanding the payment schedule is crucial as it directly impacts your financial obligations. Lenders often divide the total loan amount into equal weekly installments, ensuring borrowers maintain manageable debt levels.

By opting for weekly payments, borrowers can budget effectively, aligning their repayments with their income cycles. This approach may be particularly beneficial for those seeking debt consolidation or aiming to manage their finances more efficiently. Moreover, the vehicle’s valuation and loan approval process plays a role in determining the weekly payment amounts, influencing the overall repayment strategy.

Risks of Missed Deadlines and Repayment Consequences

Missed deadlines for car title loan weekly payments can have significant risks and consequences. One of the primary dangers is the potential for default on the loan, which can lead to repossession of the vehicle. This not only terminates the loan but also disrupts the borrower’s transportation, making it harder to maintain daily routines and obligations. Additionally, missed payments can incur substantial fees and penalties, further increasing the overall cost of borrowing.

Repayment consequences are multifaceted. Delayed or missed payments may result in a cycle of high-interest rates and additional charges, turning what was intended as a temporary solution into a prolonged financial burden. For those relying on car title loans for emergency funds or debt consolidation, these delays can exacerbate existing financial problems. Online applications offer convenience but do not excuse the responsibility to meet repayment deadlines, emphasizing the importance of maintaining punctuality and understanding the terms of the loan agreement.

Strategies to Avoid Delays and Stay on Track

Staying on top of your car title loan weekly payments is crucial to avoid missed deadlines and potential penalties. First, create a detailed budget that allocates specific funds for each payment due date. This ensures discipline and prevents overspending, allowing you to consistently meet your financial obligations. Secondly, consider setting up automatic payments; many lenders offer this service, which automatically deducts the amount from your bank account on the designated day.

Additionally, building an emergency fund can provide a safety net for unforeseen circumstances that might interfere with your loan repayments. This way, you won’t have to default on your Houston Title Loans if an unexpected cost arises. Remember, timely payments not only maintain good credit but also help you avoid the stress and potential long-term effects of delayed payments, especially when it comes to short-term loans like car title loans.

Car title loan weekly payments can be a convenient repayment method, but they also present a unique challenge of potential missed deadlines. Understanding the risks and implementing strategies to stay on track is crucial to avoiding severe consequences. By staying informed and proactive, borrowers can navigate this financial tool effectively, ensuring timely repayments and maintaining control over their loan.